Once an organisation has agreed on the genuine need for technology change, the sponsoring technology manager faces a myriad of avenues to investigate. Build or buy? Re-platform to full-suite enterprise IT ecosystems? Assemble implementation & support teams or utilise third-party expertise?

The old adage “you don’t get fired for buying IBM” has no obvious corollary in 21st Century business technology, where swathes of IT platforms exist amid integration possibilities with endless SaaS products that execute specific value chain steps, and where purchasing Infrastructure as a Service (IaaS) is an alternative to maintaining one’s own physical IT assets. The options for constructing and refining an organisation’s core IT infrastructure can precipitate the same paradox of choice that psychologist Barry Schwartz introduced in 2004 as the debilitating downside to consumer freedoms and options.

This article suggests ways to find and vet appropriate technology partners to support the realisation of your business strategy through IT infrastructure and solutions. It aims to validate the critical thinking and intuition that accompanies this process and simplify the complexity of defining and executing considerable technology change.

How it starts

Most senior technology managers, depending on the potential impact of the initiative, will likely have taken the following steps with varying depths of analysis to match the solution with the problem:

- Articulated an inefficiency, risk, or opportunity in the technology strategy

- Ideated potential pathways forward (tactical remediations, acquisition of new tools, wider-scale technology transformation)

- Canvased opinions of senior managers in other organisations

- Taken meetings with software product representatives and service consultancies

Where there’s a clear need for external expertise, there’s typically some operational expenditure available to take some immediate action or more completely define the what, how and who of an appropriate end state. As this is still an early, non-committal stage of investment and the rubber hasn’t yet hit the proverbial road, a couple of behavioural factors can come into play when the procuring organisation is forming a new (or extending an existing) supplier relationship:

Expectations are being set

By introducing consultants to internal delivery and operational personnel for discovery activities, expectations of implementation collaboration with these consultants can be implicitly set. Consultants are gathering information in the (potentially virtual) office, building familiarity, listening to problems and validating potential future ways of operating.

Senior managers find themselves being committed

With the financial year progressing and pressure to make genuine inroads on strategic priorities mounting, sponsoring managers can find themselves forgiving early signs of poor supplier alignment to create short-term momentum in defining the end state.

In the same way that expectations are implicitly being set throughout the organisation, sponsoring managers can find themselves sharing these expectations as they socialise emerging discovery outcomes with other functional leaders and become increasingly associated with the on-trial supplier as well as the strategic initiative.

These two interrelated relationship factors can contribute to ill-fated projects with ill-fitting technology suppliers that erode the technology function’s business value over time due to poor definition, execution, and solution adoption. Recent popular articles about technology supplier selection such as Bourque and Ostapchuk imply supplier selection is a single event that occurs at the conclusion of an evaluation process. This implication may result directly from the behavioural factors that tend to bind providers with sponsors at the outset.

The reality is typically more gradual, particularly when the impending project relies more on service capability than on procuring new assets or licensed services. Engaging in pre-sales, design or discovery activities offers buyers multiple opportunities to rethink their supplier selection.

How to make a lasting selection

The organisation shopping for expertise sits on the disadvantaged side of an information asymmetry, where the potential to make a poor selection is considerable and the ramifications can be detrimental. Nobel prize-winning economist George Akerlof explained in his 1970 work ‘The market for “lemons”’ that this information asymmetry can also reduce the number of quality sellers in a market, making the probability of poor selection by the buyer even higher.

But three consistent steps can be taken, before and after consultants enter the building, to ensure that a supplier is the right blend of capability, experience, and culture to add value to a technology function.

1. Identify the type of change

The scale of technology change undertaken by a business will drive a need for different external competencies. It can be useful to think of change (technology or otherwise) as sitting on a spectrum in which the magnitude increases as follows:

- Incremental changes are focused mainly on the technical aspects of change without the need for broad communication, upskilling or process changes. Software upgrades and automation of back-office tasks might fit in this group, where operational, customer and supplier touchpoints are either not impacted at all, or have administrative steps removed without significant change to overall workflow

- Transitional change involves introducing a well-understood technology to an organisation, requiring implementation effort as well as workflow adjustment and adoption management with expected low-level friction and resistance from affected users.

- Transformational change entails substantial technology shift that affects the products or services it sells, the way it produces and delivers them, as well as how and where sensitive data is stored. This level of change might consist of multiple new systems that streamline value chain support activities (think HR, finance, and IT infrastructure technologies), or replacing a core business system directly involved in production or distribution. Regardless, the change is strategically significant and carries moderate short-term risk to current business operation. The organisation will be pushed out of its comfort zone and require multiple new capabilities to introduce, adopt and sustain the transformation.

2. Match your capability needs to your change

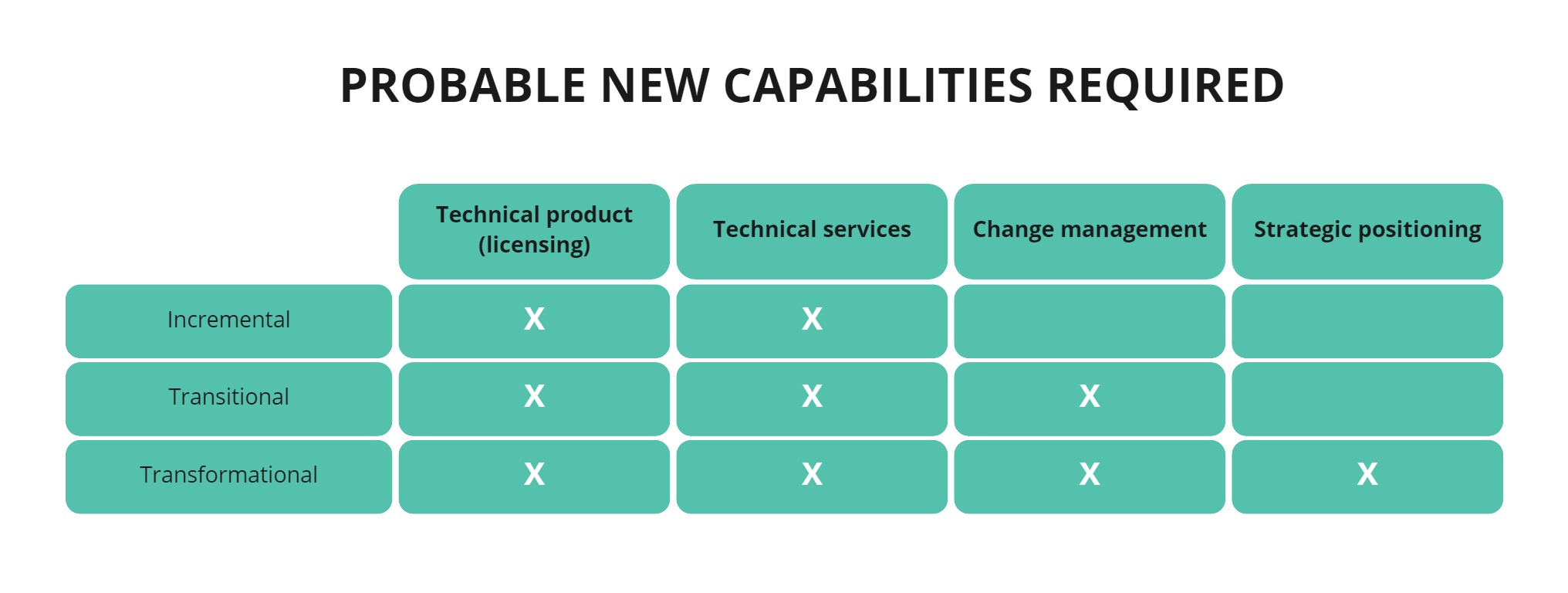

Each iteration of change will require a higher reliance on new capabilities to be successful, whether those capabilities are outsourced or insourced.

Each step up in change size from incremental to transitional to transformational progressively encapsulates more than just technical capabilities, adding complexity, effort, and risk to the initiative. Each progression is more likely to require non-technical capabilities in change management and strategic positioning, and reduce the chance that the organisation can effectively rely on in-house capabilities to execute the change. The growing complexity and newness of the change initiative makes external support essential to foresee and manage the tasks and challenges ahead.

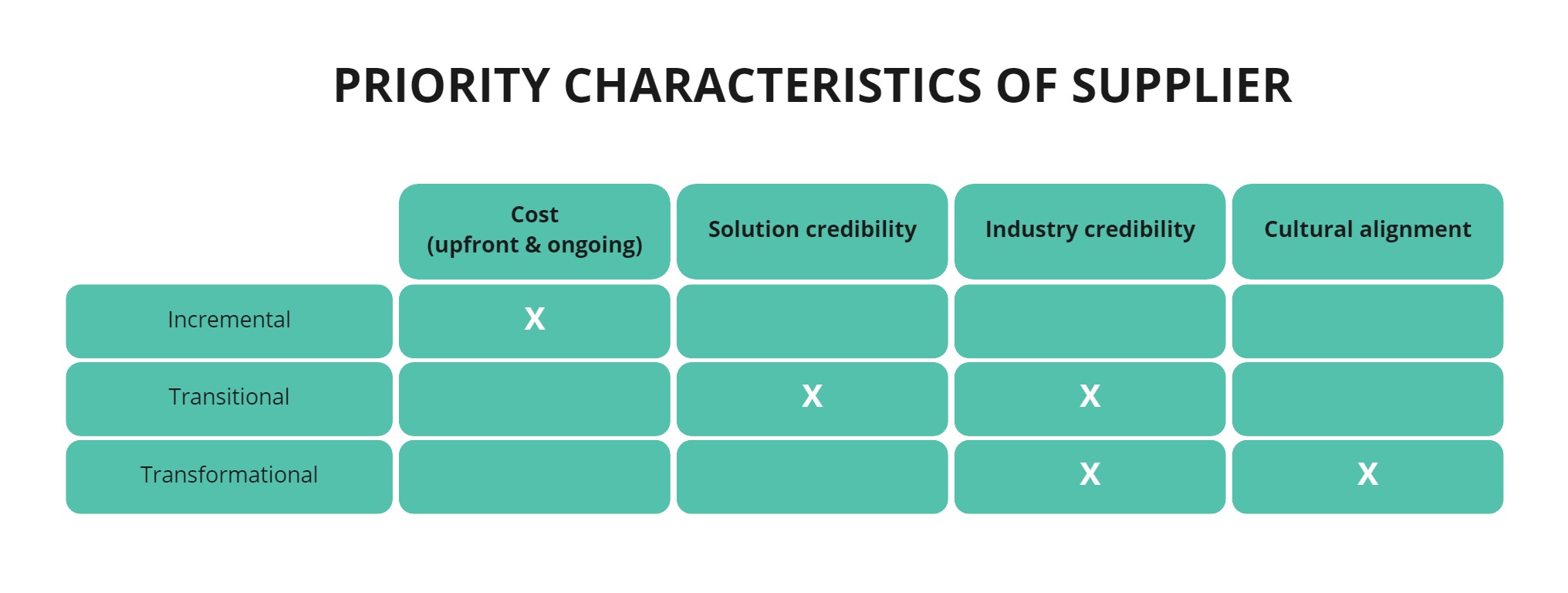

In selecting this mix of external support, the sponsoring manager can prioritise or weight different vendor characteristics based on the magnitude of change. To help to ensure the delivery of lasting business value, the organisation can prioritise as follows:

A focus on financial cost by the sponsoring senior manager is appropriate for increments because they are:

- largely invisible or benign to employees, suppliers and customers, and

- have a high degree of conformity and consistency across organisations and industries, and

- they are tactical and rely more on explicit knowledge to execute than deep expertise.

But as the nature of change starts to intersect with day-to-day operations and customer expectations, the sponsoring senior manager needs to have more confidence that the available (internal or external) capabilities will have the depth and wherewithal to anticipate and deal with nuanced challenges. These challenges overlay specific use cases, stakeholder types and compliance regulations over the base technical need.

Here, where increments become transitions, the budgetary aspect of available options – to insource, buy off-the-shelf, commission a custom outsourced solution – needs to be negotiated with the importance of credibility earned by prior success in the same technical and/or industrial context. This solution and industry credibility is demonstrated in several ways, including:

- accessible examples of similar successful changes

- access to relevant testimonials and associated advocate referees who can articulate the value of the prospective option

- ex-ante policies regarding data security, development practices, and business continuity

- appetite and aptitude to proactively shape the communications plan to facilitate awareness, understanding and adoption of the change

- ability to demonstrate practice development and going concern

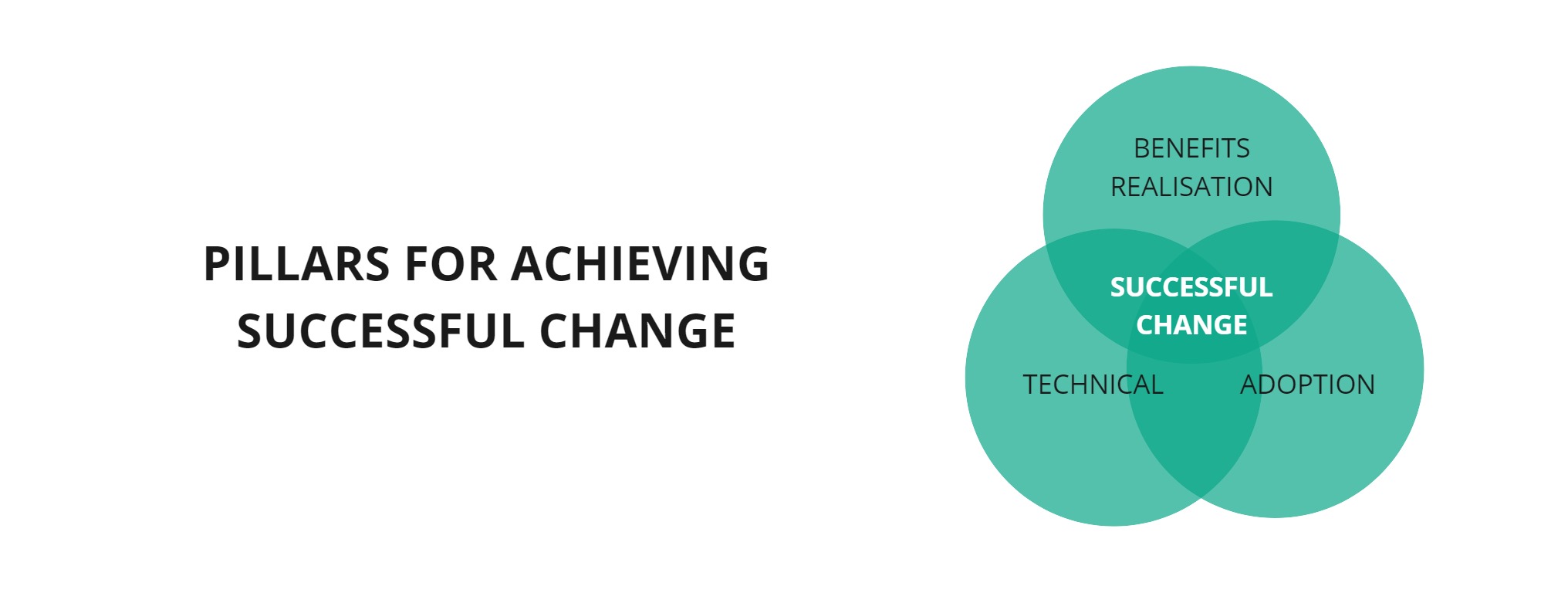

The value of this credibility is not meant as a political failsafe for the sponsor. It is a trusted source of experience-based knowledge that can be leveraged to:

- Create and manage stakeholder-appropriate information throughout the change

- Roll the change out to affected stakeholders, providing technical training, soliciting and actioning feedback, and demonstrating value against success metrics to ensure the technical solution is adopted by target users and the intended business benefits are realised.

As relatively moderate transitions evolve into the realm of transformation, the entire enterprise is affected, as are suppliers, customers and other external stakeholders. The nature of the organisation may fundamentally change as it moves to satisfy new needs, new customer segments and/or realise order of magnitude efficiencies.

This type of change is fraught with uncertainty and requires a strategic tolerance for a long payback period. Obeng (2004) classified four groups of projects based on the certainty of the goal and of how to achieve it. Enterprise transformations are akin to the least certain of these options: ‘walking in the fog’. The organisation is confident neither of the method nor of what the end state is really going to look like.

Given that uncertainty, cost, and credibility may recede in priority to a third factor: cultural alignment. To achieve a transformative technological vision, buyer/seller relationships will benefit from flexibility built on common aspirations, values, and trust precisely because statements of work and service level agreements cannot capture legal consideration that is as yet undefined.

Transformations often require risk and reward to be shared between the changing organisation and the supplier(s) of component capabilities, an informal joint venture of sorts to realise a new and mutually beneficial future.

3. Choose your technology partners

At the smaller, implementation end of the change spectrum, the sponsoring manager can forgive cultural or behavioural incongruity with suppliers. The change ought to be low-profile and low-risk enough to focus on cost as a key selection criterion. But as the scale of change and its expected benefit increase, the less tangible, interpersonal, and value-based aspects of a business relationship become as important as technical proficiency. Questions like these then become an essential part of the selection process:

- Do I trust this supplier?

- Are they showing signs of being invested in this change?

- Do they have the capability to support adoption as well as implementation?

Most crucially, the sponsor need not – should not – answer these qualitative questions in isolation. Executing pre-sales, discovery, and design phases are a great opportunity for the business sponsor to crowdsource answers to these questions from the various operational skillsets and strategy managers who are exposed to the suppliers’ personnel. Armed with a clear sense of what type of change is on the table and what types of capabilities are required, the execution of pre-build phases of relatively minor investment enable an organisation to appropriately weight the softer aspects of the relationship and select the right partner for the job.

Conclusion

Selecting a technology partner to realise strategic IT goals is a process where the odds of making a shrewd choice can be stacked against the senior sponsoring manager. By prioritising the supplier characteristics relevant to the type of change, buyers can appropriately shortlist vendors at inception, and then exploit pre-sales and discovery stages to evaluate not only cost, but the relevance of touted credentials and past experience to the specific change context.